Financial Aid Process

Financial aid checklist

Follow The Steps To Apply For Financial Aid:

STEP 1: Complete the FAFSA

- Complete the FAFSA online and enter Regent's school code: 030913

- 4-7 business days later, Regent Financial Aid Office will receive a copy

- Next, we will send your User ID and PIN by email

It is recommended you complete the FAFSA at least 6 months prior to the start of class.

STEP 2: Fulfill Financial Aid Requirements

- Access your Financial Aid Application by logging into your account. Our easy-to-follow steps are here.

- The Financial Aid Office will process your documents within 3-5 business days.

Federal student loan borrowers must complete the Entrance Counseling and MPN. Have you completed them yet? Click here

STEP 3: Review & Accept Your Awards

Payment Options:

- Federal Aid

- Institutional Aid

- State Grants

- Privately Funded

- Tuition Installment Plan

- Military Benefits

Follow the steps on accepting your awards offers here.

STEP 4: Complete Semester Check-In

Log in to MyRegent Portal and click on the Semester Check-in banner on your homepage.

- Confirm final course schedule

- View any bookstore credits

- Review final account balance or refund

- Finalize payment arrangement

Financial Aid refunds are disbursed 17 days after the first day of class.

Completing the Free Application for Federal Student Aid (FAFSA) is the most important step for many students as they create their financial readiness plan. The FAFSA reviews household income, available assets, and overall household size to create a need assessment that is unique to you. This is sent to your school of choice and used to determine eligibility for multiple types of aid. The FAFSA can be completed in three easy steps and generally takes most people less than one hour.

- Create a FAFSA Login (FSA ID)

- Collect the documents you will need

- Complete the application at fafsa.gov

Your FAFSA results will be sent to Regent as long as you provide our school code (030913). The Department of Education provides more information regarding the FAFSA here.

Priority Deadline: Regent University does not impose a FAFSA priority deadline, however we do recommend that students who wish to pursue federal aid submit their FAFSA at least two months prior to the payment deadline. It is normal for some FASFA applications to require additional student paperwork with the institution and early submission allows the student time to understand, collect, and submit any follow up document items needed. Students will receive an email once their FAFSA is received to guide them to their next steps in the application process.

Contact Information:

Admissions - Phone: 757.352.4127 | Email: admissions@regent.edu

Advising & Financial Aid - Phone: 757.352.4385 | Email: advising@regent.edu | finaid@regent.edu

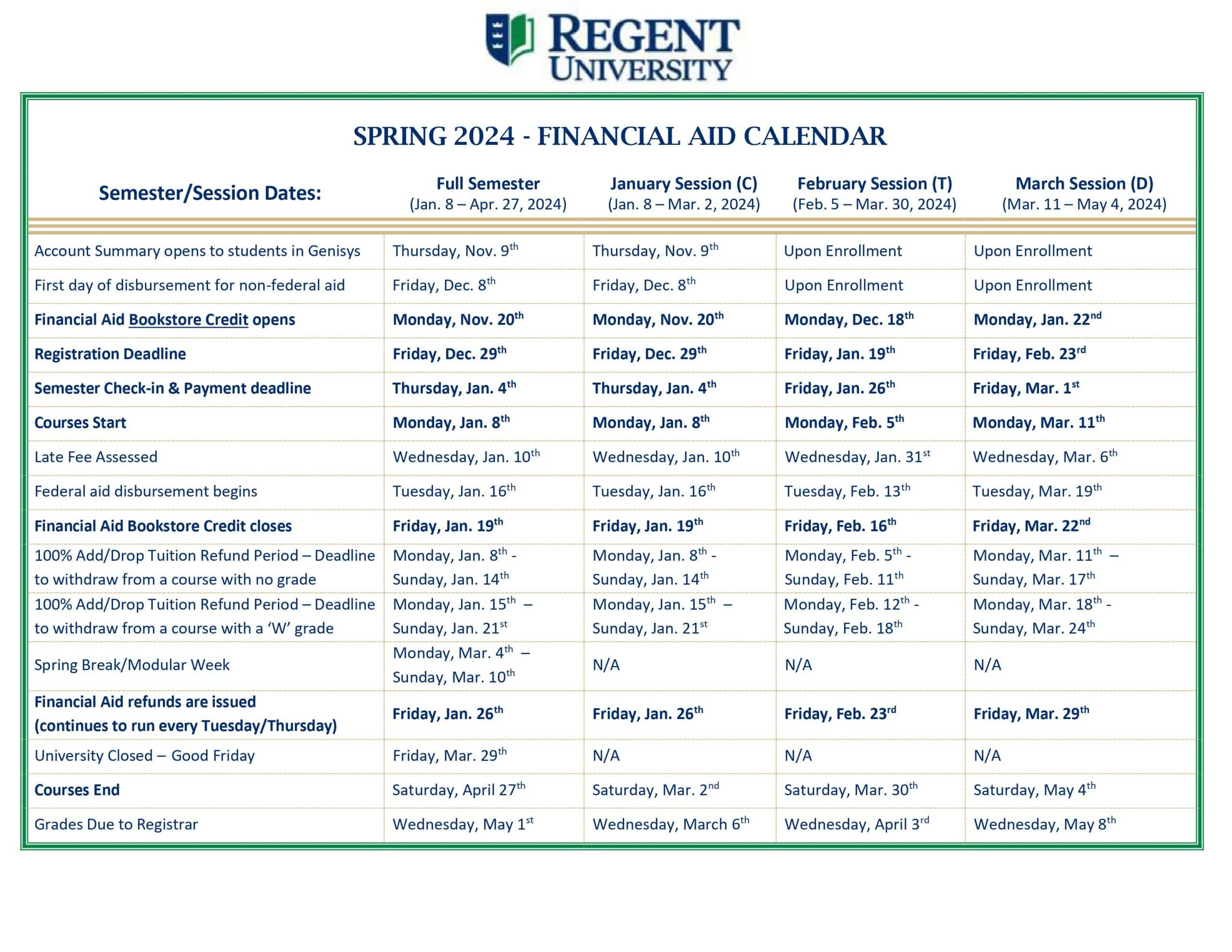

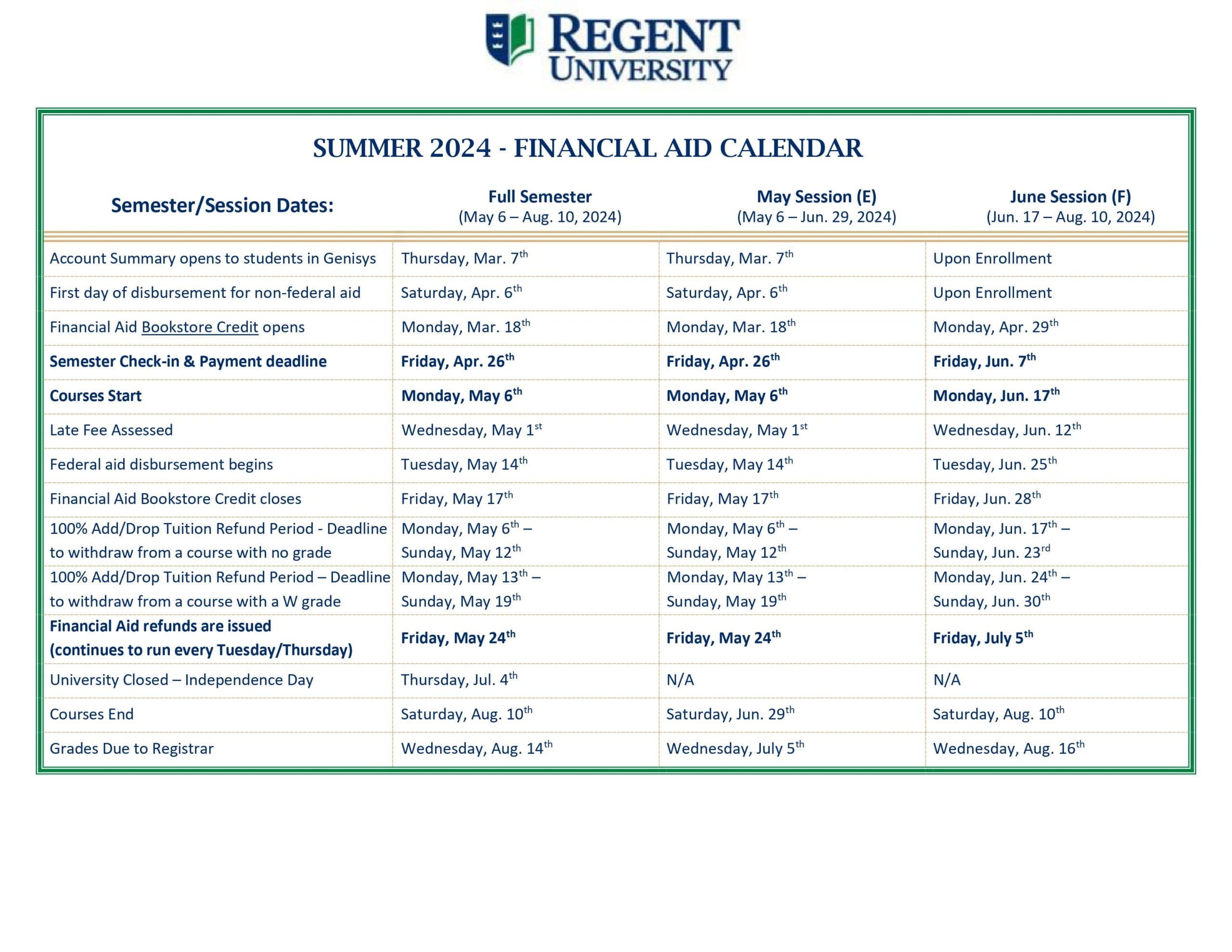

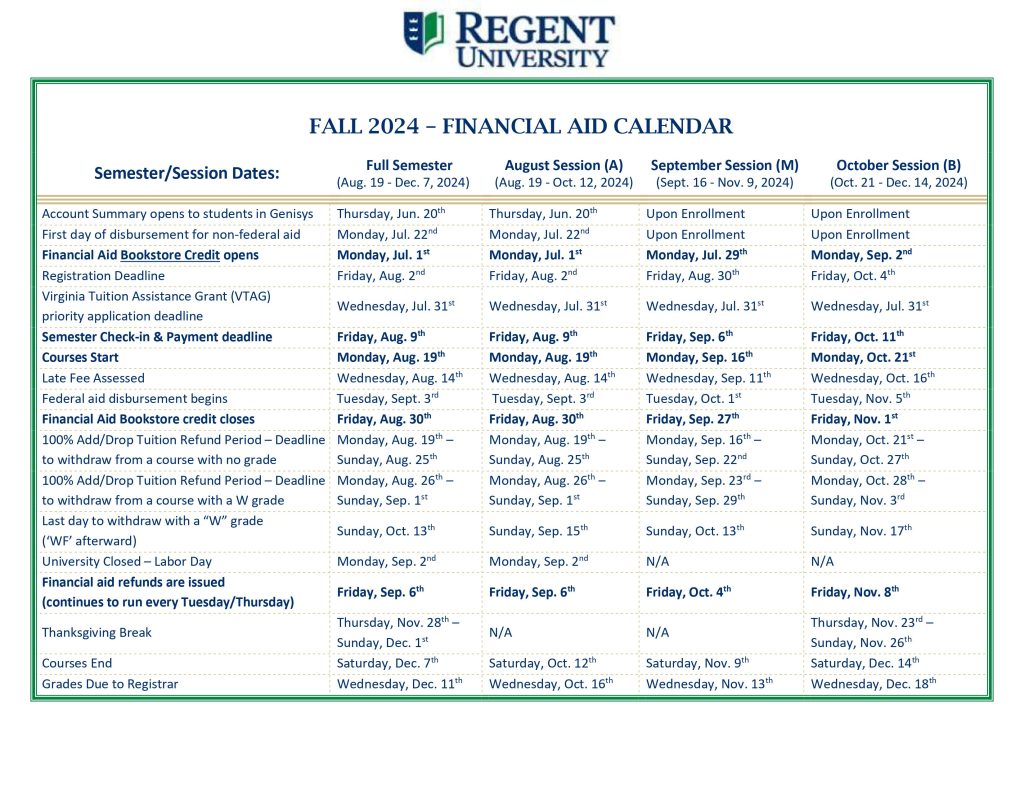

Please select the semester and session start date that is applicable to your enrollment plans.

Attention: Financial aid refunds are issued after the 100% add/drop period, approximately 17 days after the first day of class.

Policies

- With the exception of the federal Pell Grant, third-party sources authorizing such, and certain university stipend programs, no combination of scholarships and grants may exceed 100 percent of tuition. University-funded financial aid is only applicable to tuition charges for courses taken at Regent University. University-funded financial aid is not applicable to study abroad programs.

- Tuition is due and payable in full by the published deadline regardless of any pending financial aid (loans or grants). A Tuition Installment Plan (TIP) is available for a nominal fee. Contact the Business Office for more information. Failure to make payment by the established deadline will result in a late fee.

- To receive school-based awards, students must meet the eligibility criteria set out in the awarding school’s financial aid guide. If you need a copy of these guidelines, please contact your school(s) of enrollment.

- Many schools at Regent require annual resubmission of financial aid applications. Contact your individual school for more information.

- Any person who knowingly makes a false statement or a misrepresentation in his or her request for financial aid shall be subject to the provisions of Regent student discipline policies, the United States Code and/or the Code of the Commonwealth of Virginia, whichever is applicable.

- Federal student loans, Pell Grant and Virginia Tuition Assistance Grant Funds (VTAG) are conditional upon regulations/legislation in effect at the time of disbursement.

- All financial aid is to be used solely for expenses related to attendance at Regent University. Institutional scholarships will not be applied to charges related to non-Regent study abroad programs.

- Financial aid recipients who withdraw during a term, or reduce their academic load below the required minimum hours for the aid received, are subject to the provisions of the university refund policy and “Return of Title IV Funds Aid Policy” available from the Business Office. You must notify Student Financial Aid if you are enrolled, were enrolled or will be enrolled at another institution during the same award year as you are in attendance at Regent and you receive, or will receive, the Federal Pell Grant or Federal Stafford Loan (or Federal Direct Stafford Loan).

- You must be enrolled at least half-time as a regularly enrolled student in a degree-seeking program to be eligible for loans, Federal Pell Grants and most other aid available. Credit hour requirements associated with enrollment status are defined by federal law and by the University Academic Council. Visit our Financial Aid Enrollment Requirements website page here for detailed credit hour requirements required for halftime enrollment.

- If you receive additional aid (scholarships/grants) or other outside resources, your awards must be modified. Notify the Student Financial Aid of any additional resources not previously included that are available from other resources such as loans, scholarships, grants, Social Security benefits, veterans’ benefits, employer tuition payment plans and other educational assistance. Failure to do so before the first financial aid disbursement will result in a potentially significant lower subsequent disbursement. In some cases it may result in having to repay a portion of the aid received.

- Any student who receives financial aid funds, but does not attend any of the classes (or complete any distance coursework) for which the disbursement was made, is required to have the entire amount returned to the funding entity immediately. This is done by returning the payment received to Regent. Regent will, in turn, refund it to the funding entity on the student’s behalf. This may result in a balance due to the university.

- SATISFACTORY ACADEMIC PROGRESS

To qualify for aid processed through the Student Financial Aid Office, a student must be making Satisfactory Academic Progress (SAP) toward the completion of a degree program. If a student fails to meet the standards summarized below, the student will be placed on financial aid warning for the next semester of enrollment. During the financial aid warning semester, the student will be eligible to receive federal aid but must meet the standards by the end of that semester to have continued eligibility. A student will remain ineligible until the standards are met. If a student is declared ineligible, he or she may appeal to the school of enrollment for reinstatement. To be considered making SAP, a student must:- Complete at least 50 percent of all credits attempted

(67 percent for undergraduate) - Cumulative GPA of at least 3.00

(2.00 for law and undergraduate students; 2.50 for M.Div. students) - You must complete your degree within the following time frame:

- Graduate: five years

- Undergraduate: six years

- Doctoral (non-JD): seven years

Time is measured as of your first term of enrollment at that level, inclusive of periods of non-attendance. - Learn more about SAP and read the full policy.

- Complete at least 50 percent of all credits attempted

- FEDERAL PELL GRANT

The Federal Pell Grant is available only for those students in the undergraduate program. You must be admitted and enrolled as a regular degree-seeking student to be considered for eligibility. The grant is normally awarded for fall and spring semesters. If a student is not able to utilize the maximum annual Pell Grant amount in fall and spring, then a subsequent award may be made for the summer, if otherwise eligible. The grant is paid typically once per semester, after your attendance is confirmed in the second course (six credit hours) of the term. Your participation/attendance must be confirmed in all courses for which Pell Grant payment is based. If you add or drop courses during the term, your Pell Grant is subject to adjustment. You may not receive the Federal Pell Grant at more than one institution in a term.

- Private loans are not guaranteed; rather, they are based on your credit history. By accepting the loan you are giving permission to the lender to pull your credit history. If the lender determines you are not creditworthy, you will be denied or required to obtain a co-signer. Final notification of approval or denial for private loans is made by your lender.

- Grad PLUS Loans are not guaranteed; rather, they are based on your credit. By accepting the loan you are giving permission for the lender to pull your credit history. If the lender determines you are not creditworthy, you will be denied. Final notification of approval or denial for the Grad PLUS Loan is made by your lender.

- If your parent is applying for a Parent PLUS Loan, the Parent PLUS application must be completed at www.studentloans.gov. Parent Plus Loans are not guaranteed; rather, they are based on your parent’s credit. By accepting the loan and submitting the Parent PLUS application you are giving permission for the lender to pull your parent’s credit history. If the lender determines your parent is not creditworthy, your parent will be denied. Final notification of approval or denial for the Parent PLUS Loan is made by your lender.

- Loan recipients must notify Student Financial Aid in writing of any change in enrollment status, address or family financial circumstance.

- Student Loan Disbursements: student loans are disbursed in at least two equal amounts. Single term loans may be disbursed in one disbursement. Example: a loan for fall/spring will come one half in fall and the other half in spring. A fall only loan will have the entire amount arrive at once.

- Students will not receive any excess loan funds above university charges sooner than 17 days after the first day of courses if all requirements are met and loan funds have arrived. Please come prepared to cover initial expenses, including book costs. Educational loans are not intended to cover moving expenses or initial utility deposits.

- Student Loans Disbursed by Paper Check: If your loans are disbursed by paper check, rather than EFT, the check will require your endorsement, as it will be made co-payable to Regent University and the student. The loan check will be available for your endorsement in the Business Office. You will not be eligible for any funds in excess of your tuition charges until you endorse the check and the Business Office produces a refund check for the correct amount.

- Federal and Private Loans: Lenders will send you a NOTICE OF LOAN GUARANTEE AND DISCLOSURE STATEMENT that indicates the amount of the loan that has been guaranteed on your behalf. This notice contains an anticipated disbursement date. This is NOT a definite date of when funds will be available to you. It is the date the lender anticipates wiring funds to Regent (if an EFT lender) or cutting the checks to mail to Regent (if you are using a lender that processes paper checks). Refunds will be issued after the 100% add/drop period, approximately 17 days after the first day of class. Please check our Important Dates Page for more information.

- ALL FIRST-TIME FEDERAL STAFFORD LOAN BORROWERS at Regent are required to complete student loan entrance counseling before any funds may be credited to the student’s account. Entrance counseling may be completed online at www.studentloans.gov. You will be guided through a series of pages containing important information regarding student loans. You are encouraged to complete the entrance counseling requirement at least one week prior to the first day of class to help expedite the refund process. Please allow three to five business days from the time the entrance counseling is completed until the time you may pick up a refund.

- ALL student loan borrowers at Regent are required by federal law and/or Regent University or private lender policy to complete EXIT COUNSELING prior to ceasing enrollment on at least a half-time basis. Graduating students and those who drop to a less than half-time status are required to complete exit counseling. Exit counseling sessions can be completed online at www.studentloans.gov. Please allow 30 minutes to complete your session.

- Most commonly, loans will be calculated for only the fall and spring semesters. There are a few exceptions to this depending on your program of enrollment. If you are going to be taking classes during the summer term, please inform the Student Financial Aid Office by filling out the Summer Aid Request Form. Forms will be available online after the spring registration period is completed. If you have been awarded the maximum amount of $20,500 in Federal Stafford Loans for the fall and spring terms, and you choose to accept the full amount, you will not have any Stafford Loan eligibility remaining for the summer term. If you choose to attend the summer term, your loan eligibility will be available only through private loans and PLUS loans, which are based solely on your credit history.

- Your loan data will be submitted to the National Student Loan Data System (NSLDS) and will be accessible by guaranty agencies, lenders and institutions determined to be authorized users of the data system.

- Exhaust all other resources before you apply for a loan. Funds to help finance your education may be hidden in people or organizations you would not expect. Contact your employer, your church, family members or do an Internet scholarship search to see what types of aid might be available.

- Remember: Borrow only as much money as you really need.

- Maintain a loan file to keep all information pertaining to your student loans. You are responsible for knowing the name of your lender, their address and how much you borrowed. Law students will be asked this information on bar exam applications.

To qualify for federal financial aid a student must be making satisfactory academic progress (SAP). Federal financial aid includes federal loans, the Pell Grant, and theTEACH Grant.

SAP for financial aid is monitored on two standards:

- Qualitative: Cumulative GPA in your level of study (undergraduate, graduate, doctorate, etc.)

- Quantitative: Successful pace of completion of a minimum of 50 percent of all credits attempted in your academic transcript level in graduate/professional programs, and 67 percent of all credits attempted in the undergraduate level.